China Stocks Surge to 16-Year High in Market Response to Economic Stimulus Measures

China stocks experienced a significant rally, marking their best performance in 16 years, fueled by economic stimulus measures and increased investor optimism.

In a remarkable turn of events, Chinese stocks experienced a surge on Monday, marking their best performance in 16 years. The rally was fueled by recent economic stimulus measures that have ignited investment optimism in the country. The Shanghai Composite Index soared 8.06%, marking its most significant gain since September 2008 and concluding a nine-day winning streak for the index. This upswing resulted in a 17.39% increase for September, representing the first monthly gain in five months and the best performance since April 2015. Meanwhile, the Shenzhen Composite Index witnessed a remarkable 10.9% rise, its highest daily gain since April 1996, and achieved a 24.8% increase for September, the most substantial monthly gain since April 2007.

Significant Movements in U.S. Markets

The momentum in Chinese stocks reverberated across U.S. markets, with related exchange-traded funds (ETFs) also experiencing notable gains. The China ADR index climbed nearly 6%, while U.S.-listed shares of human resources company Kanzhun surged 9%. Online video company Bilibili saw a similar increase, while Tencent Music Entertainment gained 2.9% and online brokerage company Futu Holdings surged 15%. The KraneShares CSI China Internet ETF (KWEB) experienced a 4.2% increase, and the iShares China Large-Cap ETF (FXI) rose by 2.2%. Furthermore, U.S.-listed shares of Alibaba saw gains exceeding 4%, while JD.com experienced a 5.4% uptick.

Stimulus Measures and Market Reactions

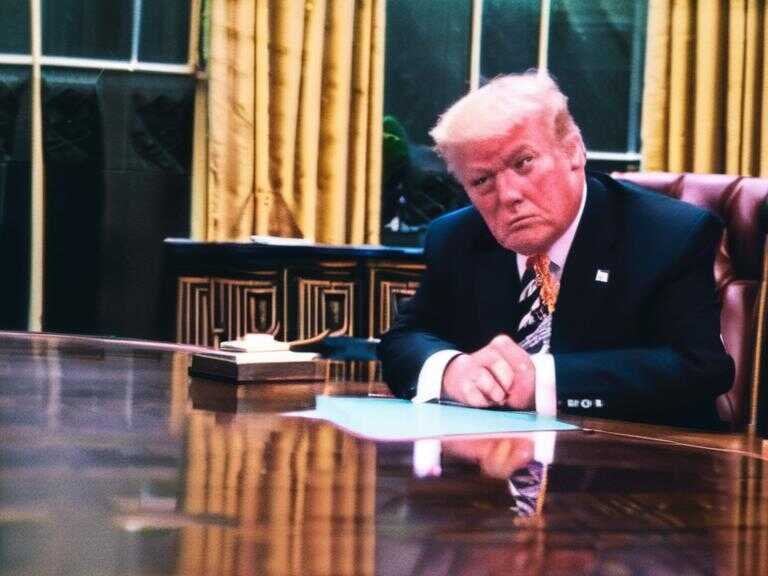

The surge in Chinese stocks can be attributed to the announcement of a series of economic stimulus measures by Beijing, aimed at bolstering the frail property market. State media revealed that Chinese President Xi Jinping and other top leaders endorsed these measures, including interest rate cuts. According to Art Hogan, chief market strategist at B. Riley Securities, while the long-term impact of these measures remains uncertain, they are viewed as a positive first step in revitalizing the economy. Hogan emphasized the importance of acknowledging the significance of a strengthening China on a global scale, indicating potential positive implications for markets.

Investor Sentiment and Future Outlook

The move to implement economic stimulus measures has bolstered the confidence of U.S. investors in the Chinese market. Billionaire hedge fund founder David Tepper expressed overwhelming bullishness on Chinese equities, revealing that he had acquired "everything" related to China following the Federal Reserve's recent rate cut. This sentiment reflects a growing optimism among investors regarding the potential for recovery and growth in the Chinese economy, suggesting a shift in expectations for future market performance.

Share news