Dollar Gains After Powell's Cautious Tone on Rate Cuts, New Zealand Dollar Edges Higher

Dollar rebounds from three-week low after Powell's cautious comments. Traders watch for signals on policy easing and rate decision.

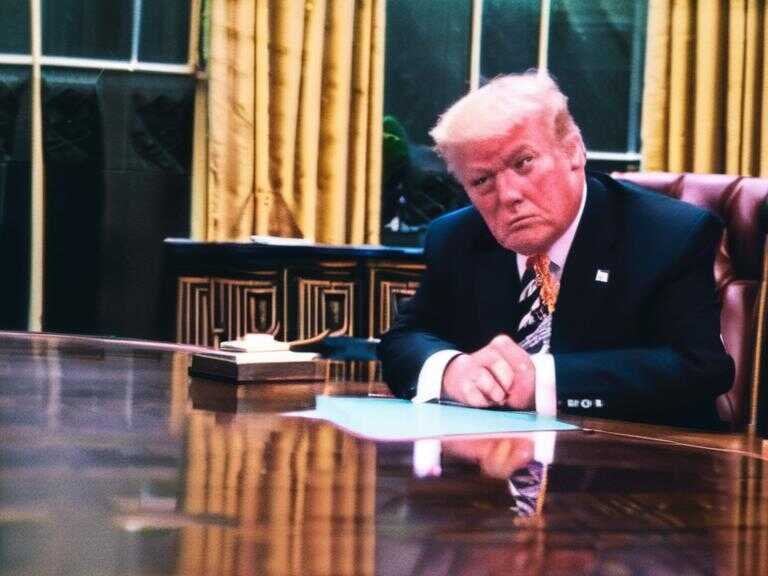

The dollar surged on Wednesday after Federal Reserve Chair Jerome Powell signaled a restrained approach to interest rate cuts, sparking a surge from a three-week low. Investors watched closely for the possible timing of policy easing by the central bank.

New Zealand Dollar Strengthens Ahead of Central Bank Decision

The New Zealand dollar showed strength as traders anticipated the central bank's rate decision. Market participants were on high alert for indications about the potential timing of policy adjustments.

Powell's Testimony and the Fed's Monetary Policy

In his initial day of testimony to Congress, Powell emphasized that a rate cut would not be suitable until the Fed is more confident about inflation moving toward the 2% target. Despite this, he acknowledged the cooling job market and the need to consider risks beyond inflation.

The dollar index, a gauge of the dollar against six major currencies, held steady at 105.11 early in the Asian session, following a 0.1% increase on Tuesday. This stability came after the index fell to its lowest level since June 13, reacting to unexpectedly soft payrolls figures.

Market Expectations and Probabilities

Market sentiment reflected a 73% likelihood of a rate cut by September, down from 76% the previous day. Furthermore, expectations indicate that a second cut is largely priced in by December.

Taylor Nugent, senior markets economist at National Australia Bank, commented, "Powell was careful not to pre-commit to a path they could still readily be knocked away from by the data flow." Nugent emphasized the challenges of firming up pricing amid upcoming Consumer Price Index (CPI) and payroll reports, which could potentially delay any action.

Future Developments and Economic Data

Following Powell's testimony to the Senate, he is scheduled to speak before the House on Wednesday. Notably, CPI data for June is set to be released on Thursday.

Performance of Major Currencies

The dollar gained 0.07% against the yen, reaching 161.41 yen. The euro remained unchanged at $1.0815. Australia's dollar was relatively stable at $0.6739, close to its six-month peak of $0.67615 from Monday. Meanwhile, New Zealand's kiwi rose by 0.1% to $0.6131, maintaining a relatively stable trend after a modest retreat from its three-week peak of $0.6171 earlier this week.

Central Bank Decision and Market Anticipation

The Reserve Bank of New Zealand is widely anticipated to maintain the current interest rates when it announces its policy decision at 0200 GMT. The central bank is taking its time in assessing whether inflation has been effectively managed, having previously indicated the possibility of another rate hike.

Kristina Clifton, a senior economist at Commonwealth Bank of Australia, noted, "The RBNZ could note the risk of inflation easing faster than anticipated." Clifton suggested that if this occurs, financial markets could fully price in the first RBNZ rate cut in October, rather than November as presently anticipated, leading to a retreat in the kiwi to NZ$1.1031 per Aussie dollar. The Australian dollar last traded at NZ$1.0996.

Share news