Expert Warns Against Trump's Protectionist Policies, Blames Trade Deficits and Strong Dollar

Protectionism due to trade deficits and a strong dollar led to Trump's tariffs on imports, sparking critiques from economists. Koo suggests managing exchange rates to prevent economic damage.

The Economic Impact of Protectionism and Trade Deficits in the U.S.

Decades of trade deficits and a strong dollar have had a profound impact on the U.S. economy, leading to the rise of protectionist policies and creating a significant number of "losers," as stated by Richard Koo, chief economist at the Nomura Research Institute.

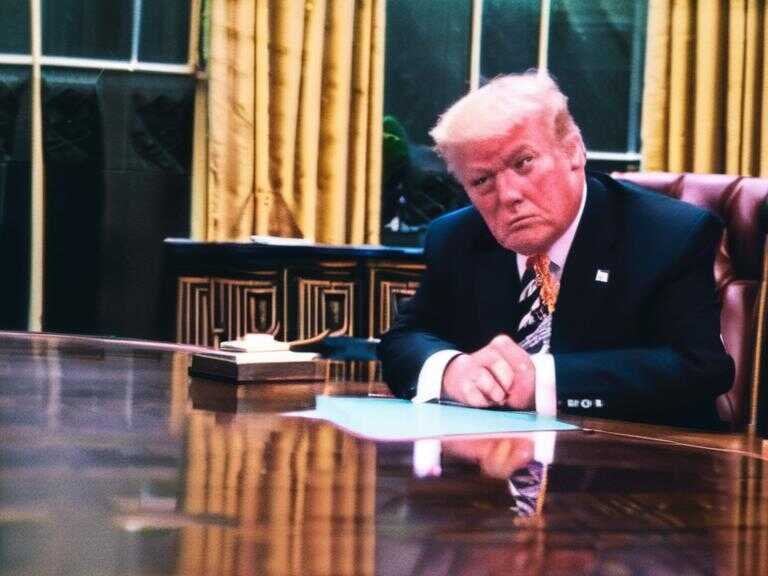

Trump's Protectionist Policies and Tariffs

The "America First" economic policies implemented by the Trump administration have resulted in the imposition of trade tariffs on various countries, including China, Mexico, and the European Union. This includes the application of 25% duties on imported steel and aluminum. As the Republican nominee for the 2024 presidential election, Trump has proposed a baseline 10% tariff on all U.S. imports and a minimum levy of 60% on imported Chinese products.

Criticism and Economic Impact

Economists have widely criticized these protectionist measures, arguing that tariffs lead to increased costs for imported goods, ultimately impacting the average American consumer.

Protectionism and Economic Logic

Richard Koo acknowledged that while protectionism is generally considered a detrimental economic approach, he suggested that there is a certain degree of economic logic in Trump's strategy. He emphasized that the traditional economic view of free trade creating more winners than losers is based on the assumption of balanced or surplus trade flows, which has not been the case for the U.S. due to persistent trade deficits.

Exchange Rate and Foreign Trade

Koo identified the exchange rate as a pivotal factor, pointing out that the strength of the U.S. dollar has incentivized foreign imports and adversely affected U.S. companies engaged in global exports.

Historical Perspective: President Reagan's Response

Koo drew parallels with a similar scenario in 1985 when President Ronald Reagan faced challenges posed by a strong dollar and increasing protectionism. Reagan responded by orchestrating the Plaza Accord with several major economies to devalue the U.S. dollar, highlighting the significance of proactive exchange rate management.

Redefining the Trade Deficit

Koo advocated for a shift in the understanding of trade deficits, suggesting that it is not solely a result of imbalanced investment and savings. He argued that the deficit cannot be rectified by prolonging a recession to diminish domestic demand and facilitate increased exports.

Exchange Rate and Company Profits

Koo referenced historical conflicts with Japanese companies in the 1970s, illustrating that the issue extended beyond investment and savings. He emphasized that a weaker dollar could have averted the adverse impact on U.S. companies and prevented the rise of trade-related "losers."

Lesson from History

Ultimately, Koo underscored the importance of proactive management of the exchange rate to mitigate the detrimental effects of a strong dollar and trade deficits, drawing from the historical response of President Reagan.

Share news