GameStop completes $2.14 billion share offering after Keith Gill's livestream resurgence

GameStop completes $2.14 billion share offering after Keith Gill's livestream. Stock rises 5%, then falls. Proceeds for corporate use. CEO's stake decreases.

GameStop announced on Tuesday the successful completion of its "at-the-market" equity offering, raising approximately $2.14 billion in gross proceeds. This move comes just days after the return of meme stock influencer Keith Gill's first livestream in three years.

Following the announcement, GameStop's shares initially surged over 5%, but later reversed course to a 1.6% decline in volatile extended trading. Keith Gill's livestream on Friday, which attracted over 600,000 viewers, featured humorous references to memes alongside discussions of GameStop, closing the session with the stock down nearly 40%.

Offering Details

GameStop confirmed the sale of the maximum 75 million shares registered under the program. Based on Reuters' calculations, the average sales price per share stood at approximately $28.50, while the company's shares closed at $30.49 after Tuesday's trade. The company stated its intention to allocate the raised funds for general corporate purposes, including potential acquisitions and investments.

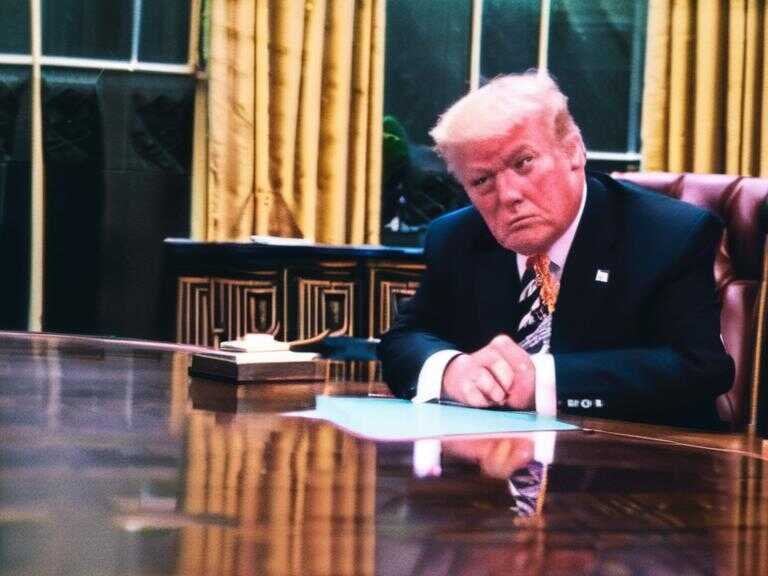

CEO's Stake and Previous Offerings

GameStop's CEO Ryan Cohen's stake in the company decreased to 8.6% as of June 10, from 10.5% as of May 22, as per a regulatory filing on Tuesday. In May, the company had raised $933.4 million by selling 45 million shares, amid a retail buying frenzy triggered by Gill's return on social media.

Keith Gill, also known as "Roaring Kitty" on YouTube, was a driving force behind the 2021 meme stocks frenzy due to his bullish calls on GameStop. His optimistic case for the company, shared through Reddit posts and YouTube streams, attracted significant retail investment to the struggling retailer.

Share news