Global Investors Monitor Interest Rate Decisions in Face of Expectation for Cuts

Most central banks prepared to cut interest rates in 2024 as inflation eases, with exceptions in China and Japan.

As the world economy continues to grapple with the impact of inflation, central banks around the globe are under intense scrutiny for their interest rate decisions. Here's a comprehensive look at the current state of interest rates in major economies and the outlook for potential rate cuts.

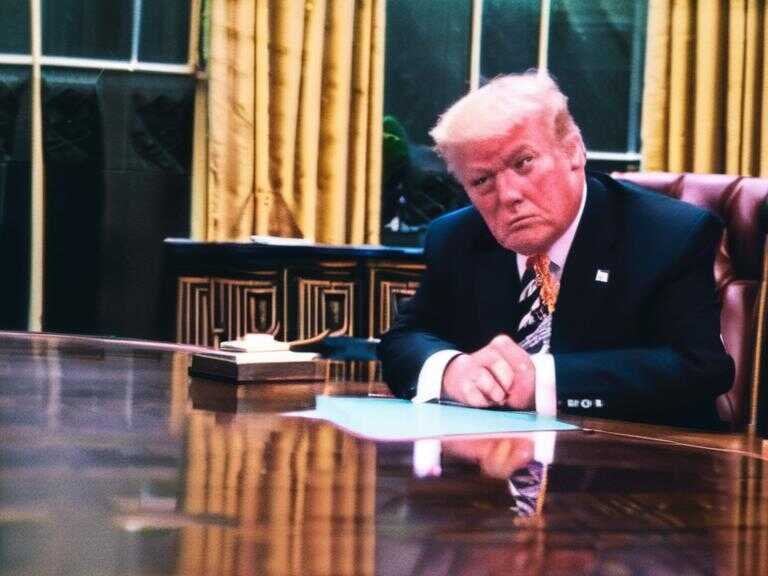

United States

The U.S. Federal Reserve is closely monitoring inflation signals, with an annual inflation rate of 2.4% exceeding the Fed's 2% goal. The Fed is expected to initiate a 25-basis-point rate cut in June, signaling a shift in its monetary policy.

Europe

The European Central Bank (ECB) maintained its policy rate at a record high of 4%, indicating a postponement of rate cuts until June. Despite acknowledging a faster-than-anticipated easing of inflation, the ECB lowered its annual inflation forecast from 2.7% to 2.3%, aiming to align with its 2% inflation target.

Switzerland

Swiss inflation in February rose by 1.2% year-on-year, the lowest reading in almost two and a half years. This has fueled expectations that the Swiss National Bank might consider trimming its interest rates in the upcoming meeting, with a possibility of a 25-basis-point cut.

Canada

The Bank of Canada (BOC) has maintained its rates unchanged for the fifth consecutive meeting, expressing caution about considering a cut despite a slight slowdown in inflation, which decreased to 2.9% in January, within the BOC's target range of 1% to 3%.

Turkey

Turkey's central bank concluded its tightening cycle after eight consecutive hikes, leaving its interest rate steady at 45% in February. Despite the high rate, the country's inflation remains at around 65%, prompting speculations about a potential policy rate cut at the end of the year.

Australia

The Reserve Bank of Australia (RBA) held its rates at a 12-year high of 4.35% in February, with expectations of future rate cuts in August as inflation eases and unemployment rises. However, the RBA is anticipated to carefully navigate to prevent a recession.

New Zealand

The Reserve Bank of New Zealand (RBNZ) maintained the official cash rate at 5.5%, forecasting a re-entry of inflation into the 1% to 3% per year target band by September. Anticipations suggest that the RBNZ may not initiate a cash rate cut until November.

Indonesia

Bank Indonesia has decided to keep its benchmark policy rate at 6%, with considerations for a potential 75 basis point cut in the second semester of the year, contingent on the global monetary policy direction, particularly that of the U.S.

Japan and South Korea

Contrary to the global trend, the Bank of Japan is expected to move toward raising interest rates instead of cutting, contingent upon annual wage negotiations. On the other hand, South Korea's central bank has maintained its rates steady at 3.5%, with speculations of being one of the first in Asia to cut rates due to ongoing disinflation and subdued private consumption.

Outlook and Anticipations

Analysts anticipate 2024 to be a pivotal year for a potential pivot towards rate cuts in several economies, aligning with the global trend. However, Asian central banks may not initiate rate cuts ahead of the U.S. Federal Reserve due to the relative weakness of their currencies against the strong U.S. dollar, which could pose higher inflation risks.

While the global trend is veering towards a potential easing of interest rates, the cautious approach of central banks reflects the delicate balance they must strike between addressing inflation concerns and supporting economic growth.

Share news