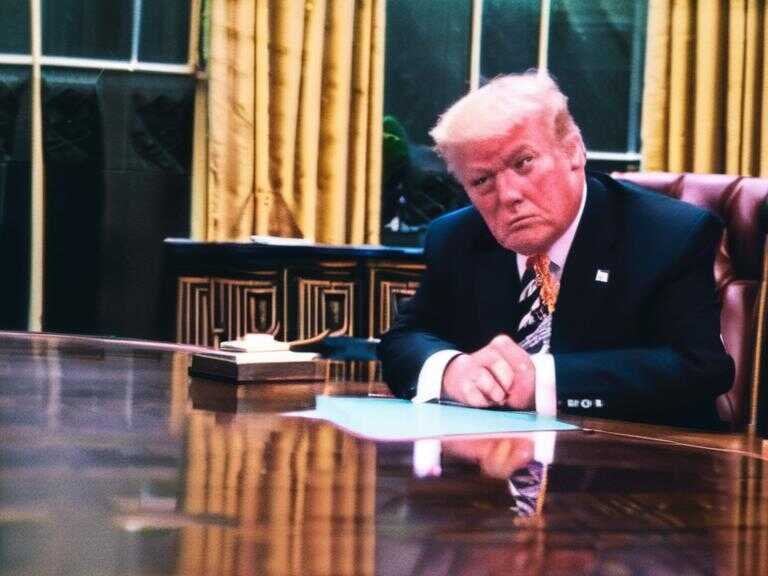

Goldman Sachs: 5% Threshold on 10-Year Treasury Yield Could Spoil Stocks' 2024 Rally

The 14th annual CNBC Delivering Alpha Investor summit on November 13, 2024, discusses the impact of rising bond yields on stocks.

The 14th annual CNBC Delivering Alpha Investor summit, scheduled for November 13, 2024, has placed a spotlight on the volatility in the bond market and its potential impact on equity investors. The question on everyone's mind is: At what point will rising yields spoil stocks' 2024 rally?

Goldman Sachs' Analysis

According to a new 19-page paper by Goldman Sachs, the answer lies at 5% on the 10-year Treasury yield. Drawing on market data since the 1980s, the Wall Street firm asserts that when the 10-year Treasury yield reaches this threshold, the correlation between bond yields and stocks turns negative. In the words of Peter Oppenheimer, chief global equity strategist at Goldman Sachs, "Historically, bond yields at around 5% become a clear problem for equities, marking the point where the correlation with bond yields is no longer decisively positive."

Market Reaction

Following this analysis, the benchmark 10-year yield surged by 5 basis points on a recent Tuesday to 4.67% after data revealed a greater-than-expected increase in employee compensation costs at the beginning of the year. This uptick serves as another warning signal regarding persistent inflation, leading the market to believe that the Federal Reserve will likely maintain its current stance until later this year before contemplating rate cuts. Notably, a basis point equals one-hundredth of a percentage point.

Investor Sentiment

Goldman Sachs identifies the current phase as the "optimism phase" of the cycle, characterized by growing confidence and complacency that drive valuations higher. As stated by the firm, "Equity valuations are higher and the cycle is more mature so equity markets are very sensitive to moves in bond yields." It further notes that equities underperform when bond yields rise due to news of overheating and higher inflation, while they outperform when the market anticipates interest rate cuts by Central Banks.

Market Adjustments

Throughout the year, the 10-year Treasury yield has climbed nearly 80 basis points, adjusting to a higher-for-longer rate regime. Notably, the current rate on the Federal Reserve's fed funds for overnight lending stands at 5.25%-5.50%. Initially forecasting at least six interest rate reductions, the market now places a 75% probability on just one rate cut, according to the CME Group's widely followed FedWatch tracker. This tracker derives its probabilities from the trading positions of 30-day fed funds futures. The Federal Open Market Committee, responsible for setting interest rates, commenced its two-day meeting on the aforementioned Tuesday.

Share news