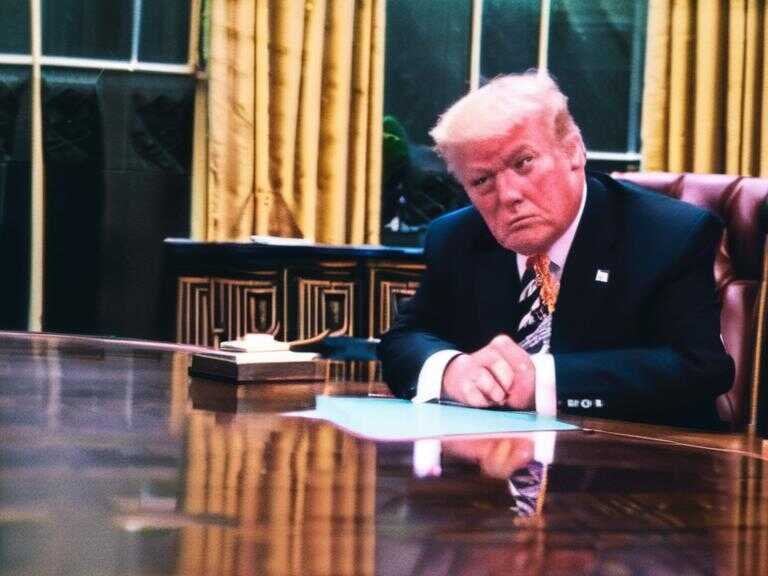

Minneapolis Fed President Expects Smaller Interest Rate Cuts After Half-Point Reduction

Minneapolis Fed's Neel Kashkari anticipates smaller interest rate cuts ahead after the recent half-point reduction, emphasizing the need for a balanced approach.

Minneapolis Federal Reserve President Neel Kashkari expressed on Monday his expectation for a moderation in the pace of interest rate cuts following the recent half-percentage point reduction by the Federal Open Market Committee (FOMC) last week. Kashkari shared his insights during an interview with CNBC's "Squawk Box," emphasizing the need for a *calibrated approach* to interest rate adjustments moving forward.

Kashkari's remarks came in response to the surprising decision by the FOMC to lower its benchmark overnight borrowing rate by half a percentage point, marking the first such reduction since the early days of the Covid pandemic, and the first of that magnitude since the 2008 financial crisis. He highlighted the importance of this move in reflecting a shift in policy focus from combating *inflation* to addressing uncertainties in the *labor market*. Additionally, he suggested that the central bank may revert to more conventional adjustments in quarter-point increments as they navigate the evolving economic landscape.

Priority on a Healthy Labor Market

Kashkari underscored the significance of maintaining a strong and healthy labor market while acknowledging the positive trend in recent inflation data indicating progress toward the Federal Reserve's target of 2%. He emphasized the need for a balanced approach, stating, "So I don't think you're going to find anybody at the Federal Reserve who declares mission accomplished, but we are paying attention to what risks are most likely to materialize in the near future."

Normalization of Monetary Policy

The rate cut signaled the Federal Reserve's intention to normalize interest rates and align them with a "neutral" position that neither stimulates nor constrains growth. According to the latest economic projections from FOMC members, the neutral rate is estimated to be around 2.9%, compared to the current target range of 4.75% to 5% for the federal funds rate.

Diverse Perspectives within the Federal Reserve

While Kashkari advocated for a cautious approach, other Federal Reserve officials expressed more optimistic views. Atlanta Fed President Raphael Bostic highlighted the expedited progress on inflation and the labor market, suggesting a more aggressive approach to normalizing monetary policy. Bostic emphasized the flexibility offered by the recent rate cut, enabling the FOMC to adjust the pace of easing based on inflation trends and labor market developments.

Share news