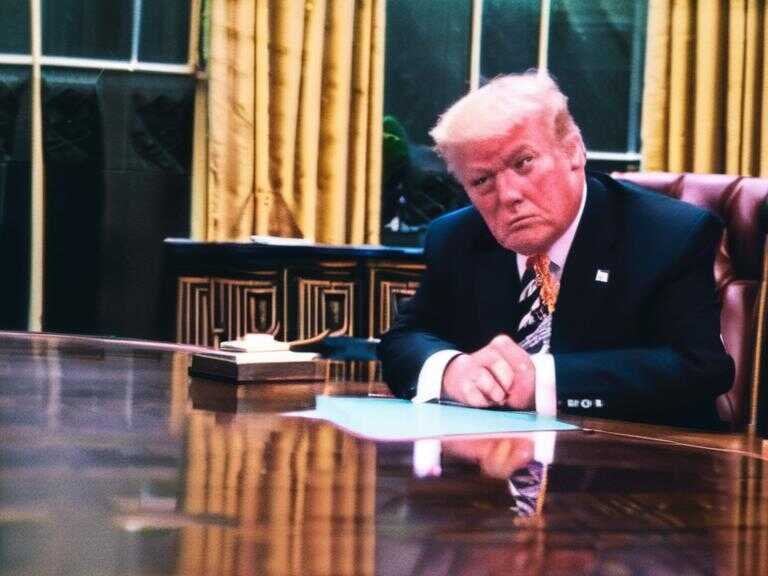

Tesla Annual Meeting to Feature Final Vote on Musk's Controversial Pay Package

Tesla's annual meeting will include a final vote on a controversial proposal involving Elon Musk's stock options.

The annual meeting of Tesla, scheduled for Thursday at 4:30 p.m. ET, will center around a crucial vote on a proposal related to Elon Musk's stock options granted in 2018. The outcome of this vote will greatly impact the future trajectory of the company.

Court's Ruling and Shareholders' Role

The proposal for consideration has come into being due to a ruling by a Delaware court in January that ordered the rescission of the compensation package awarded to Musk. It was found that Tesla's board members lacked independence from Musk and failed to provide shareholders with a comprehensive picture prior to voting on the 2018 pay plan.

Ann Lipton, a corporate and securities law trial attorney, highlighted that shareholders are not in a position to overturn the judge's ruling. Furthermore, a vote in favor will only lead to further complexities in the legal disputes.

Investor Stance and Potential Implications

Significant institutional investors, such as CalPERS, CalSTRS, Norway's sovereign wealth fund, and SOC Investment Group have firmly expressed their opposition to the pay plan. They have cited reasons including excessive compensation, dilution to shareholders, and the plan's lack of correlation with Tesla's long-term profitability.

Despite this, Tesla has reported that several institutional shareholders disagree with the court's decision and have signaled their support for reinstating Musk's pay package. The stock market responded positively on Thursday, with Tesla shares rising by 2.9% after Musk's statement indicating favorable shareholder approval for his pay package and the company's incorporation move to Texas.

Potential Implications of the Vote

Sarath Sanga, a Yale Law School professor, explained that the vote serves as an attempt by the company to rectify the court's findings of a defective process in the compensation negotiation. A resounding shareholder vote in favor of the pay plan could potentially influence future judicial decisions.

Shareholders are also set to determine whether Tesla should relocate its incorporation site from Delaware to Texas. Additionally, a proposal related to anti-harassment and discrimination efforts is on the agenda, despite the company's recommendation for investors to reject it. This comes amidst ongoing legal issues faced by Tesla and SpaceX regarding alleged discrimination.

Musk's Vision and Investor Sentiment

Despite Tesla's challenges, Musk has been vocal about the company's future direction, emphasizing the role of artificial intelligence software, robotaxis, and robotics. He has urged shareholders to focus on the company's potential in these areas rather than its current state.

While Musk's promises regarding self-driving technology have yet to materialize, some shareholders, such as Altimeter Capital CEO Brad Gerstner, remain optimistic about Tesla's position in AI and self-driving technology.

The outcome of the annual meeting will undoubtedly have far-reaching implications for Tesla's future operations and Musk's position within the company.

Share news