Tesla shares plunged 29% in worst quarter since 2022, biggest loser in S&P 500

Tesla's stock plunged 29% in Q1 due to China competition, production issues in Europe, and challenges in developing new products.

Tesla's First Quarter Performance

It was a tough start to the year for Tesla investors, as the company saw a sharp decline in its stock value. In the first quarter of the year, Tesla's shares fell by 29%, marking the worst quarter for the company since the end of 2022. This decline also positioned Tesla as the biggest loser in the S&P 500, with the third worst performance since the company went public in 2010.

Concerns on Wall Street

One of the main concerns among investors on Wall Street is Tesla's core business. Despite price cuts and incentives for buyers throughout the quarter, the company is expected to report sluggish results for first-quarter vehicle production and deliveries. Analysts were anticipating around 457,000 deliveries for the period, representing an 8% increase from the previous year. However, estimates for the quarter varied from 414,000 to 511,000 deliveries, with some industry experts expecting even lower numbers.

Challenges in China

Tesla faced significant competition in China, particularly from a wave of fully electric vehicles entering the market at lower price points compared to Tesla's popular models. This intensified competition led to a drop in Tesla's sales in China and prompted the company to reduce production at its Shanghai factory.

European Setbacks

Production disruptions in Europe, stemming from component shortages and environmental protests, further impacted Tesla's performance. Attacks on shippers in the Red Sea resulted in a shortage of components and forced Tesla, along with other manufacturers, to suspend production. Additionally, dramatic environmental protests in Germany led to a temporary suspension of production at Tesla's car and battery factory in Brandenburg.

Product Challenges

While electric vehicle sales are gaining popularity globally, the growth rate has slowed, and Tesla faces the challenge of introducing new products to remain competitive. The highly anticipated Cybertruck is still in its early stages and has a niche audience. Additionally, Tesla's efforts to refresh its Model 3 and introduce a more affordable EV, known as the "Model 2," are still in progress and will take time to materialize.

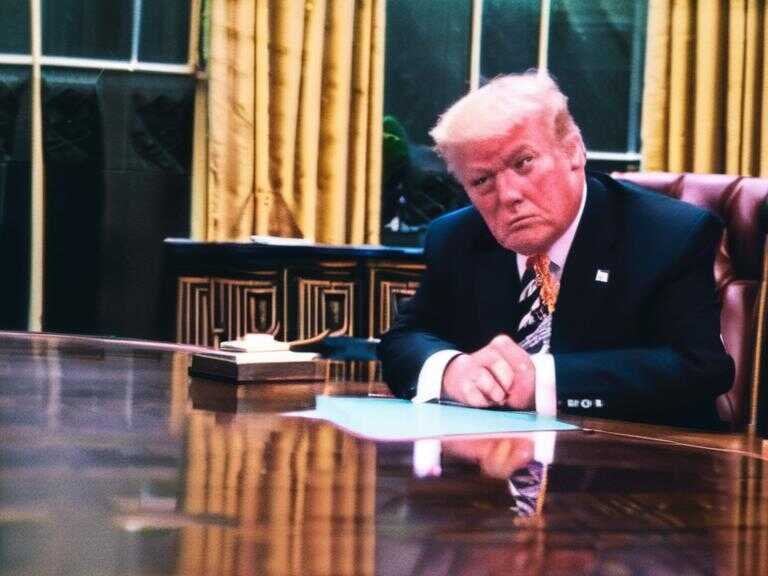

Leadership and Vision

Tesla's CEO, Elon Musk, has been at the center of attention for his political activism and outspoken views, which have generated both support and criticism. Musk's involvement in political issues and his push for more control over Tesla have raised concerns among shareholders and industry observers.

Market Performance

Tesla's challenging first quarter led to a significant loss in market capitalization, resulting in a lucrative period for short sellers. Despite ongoing promises regarding self-driving technology and advanced vehicle capabilities, Tesla has yet to deliver on some of these commitments.

Future Outlook

As Tesla navigates the complexities of the global electric vehicle market and addresses internal and external challenges, the company's performance in the coming months and its ability to innovate and adapt will be closely watched by investors, industry analysts, and consumers.

Share news