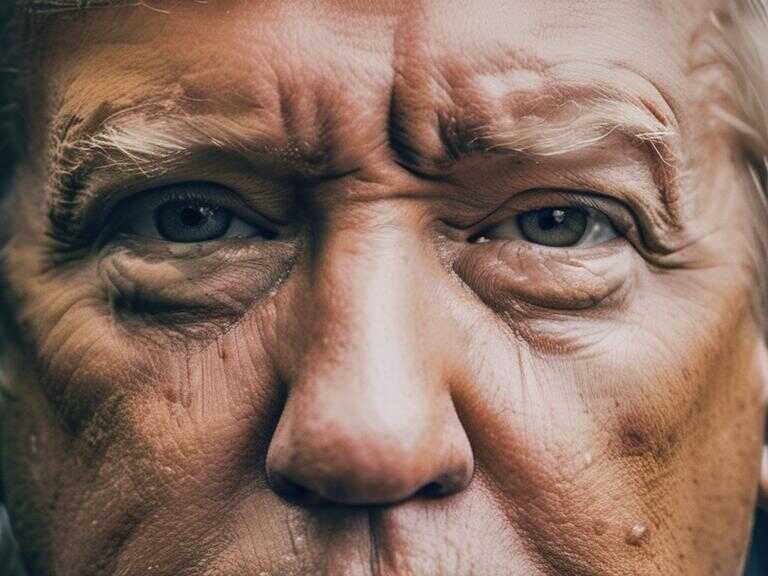

Trump Proposes 10% Cap on Credit Card Interest Rates to Ease Consumer Debt Burden

Trump's proposal to cap credit card interest rates at 10% aims to alleviate financial burdens on Americans struggling with rising debt amidst a competitive presidential race.

In a stunning turn of events, former President Donald Trump has once again shaken up the political landscape with a bold economic policy proposal. Following a series of pledges that includes free in vitro fertilization treatments for women, no federal income tax on tips, tax-free overtime pay, and an exemption from income tax on Social Security benefits, Trump has now added a significant promise to his campaign platform – a plan to cap credit card interest rates at approximately 10% if he secures the presidency in the upcoming election in November.

Trump's Announcement

At a rally in New York on September 18, Trump made the ambitious announcement, stating, “While working Americans catch up, we’re going to put a temporary cap on credit-card interest rates. We can’t let them make 25% and 30%.” This proclamation comes at a crucial juncture in the highly contested presidential race, where Trump is vying for the support of voters against his unexpected rival, the Democratic nominee, Vice President Kamala Harris.

Trump's proposal comes in the backdrop of a mounting credit card debt crisis in the United States. Data from TransUnion revealed that the average credit card balance surged to $6,329 in the second quarter of 2024, up from $4,828 during the same period in 2021. Additionally, the current delinquency rate of over 3% is the highest recorded since 2011, according to Federal Reserve statistics. These figures underscore the pressing need for relief measures for American households grappling with escalating financial burdens.

Potential Impact

If implemented, Trump’s proposed interest rate cap could profoundly affect both consumers and the financial industry. As per Bankrate senior industry analyst Ted Rossman, the average interest rate on credit cards exceeds 20%, with certain cards charging as much as 36% APR. “A 10% cap would completely upend the credit card market,” he stated, highlighting the magnitude of the potential shift.

Campaign spokesperson Karoline Leavitt emphasized that the intention behind the proposal is to provide immediate relief for hardworking Americans, particularly those struggling to make ends meet amidst soaring costs of mortgages, rent, groceries, and gas. However, while the promise resonates with many, the feasibility and mechanization of such a cap remain to be elucidated by the Trump campaign.

On the opposing side, Vice President Harris has not specifically endorsed the idea of capping credit card interest rates. Instead, she has centered her campaign discourse on alleviating the debt burden on Americans, pledging to eliminate medical debt for millions of households and highlighting efforts to secure federal student loan forgiveness.

Challenges to Implementation

While the concept of a national interest rate cap sounds appealing in theory, the reality of its implementation poses significant challenges. Adam Rust, director of financial services at the Consumer Federation of America, pointed out that the authority to set bank interest limits is predominantly vested in the states, as most credit cards are issued by banks located in states with permissive regulations, such as South Dakota, Delaware, or Utah.

Moreover, experts assert that even if Trump were to assume the presidency, he would not possess the unilateral authority to impose a nationwide interest rate cap. Legislative action from Congress would be requisite to effectuate such a change, likely necessitating an amendment to The Truth in Lending Act. However, previous attempts to pass bills aimed at capping credit card interest rates have faced obstacles, with efforts to establish a 36% cap and another to impose an 18% cap faltering in the legislative arena.

Debate and Skepticism

The proposal has elicited divergent responses from various quarters. Critics, including Lauren Saunders from the nonprofit National Consumer Law Center, expressed skepticism regarding the efficacy of a second Trump presidency in ameliorating loan terms for borrowers. Saunders highlighted the past administration’s actions that undermined consumer protections, raising concerns about the potential implications of a 10% interest rate cap.

Furthermore, some financial experts cautioned against the unintended consequences of such a cap. They posited that banks might respond to a substantial reduction in permissible interest rates by tightening their credit criteria or reducing the availability of credit cards to higher-risk consumers. This, they argued, could inadvertently exacerbate access to credit for certain segments of the population.

Potential Industry Response

Industry stakeholders have expressed apprehensions about the impact of a prescribed 10% interest rate cap on the availability and affordability of credit. They argue that if banks were confined to lower interest rates, the profitability of extending credit could dwindle, potentially leading to a contraction in the credit market and diminished access to favorable financing options for consumers.

Conversely, consumer advocates contend that leveraging the banking industry’s cautionary predictions should not overshadow the case for imposing a reasonable interest rate cap to protect consumers from exorbitant charges. They underscore the importance of striking a balance between safeguarding consumer interests and ensuring a sustainable credit ecosystem.

Regulatory Considerations

The regulatory landscape surrounding credit card interest rates is complex, with limited national provisions governing interest rate limits. The Military Lending Act of 2006 established a 36% cap on certain lending products for active duty service members and their families, while federal credit unions are typically bound by an 18% limit on credit card interest rates. However, beyond these stipulations, the authority to regulate bank interest rates predominantly resides with individual states, resulting in a fragmented regulatory framework.

This decentralization of power has led to variations in interest rate limits across different jurisdictions, with some states adopting permissive regulations that have facilitated the proliferation of credit cards issued by banks in regions with lenient rules, notably South Dakota, Delaware, and Utah. Consequently, any attempt to impose a uniform interest rate cap at the national level would necessitate navigating the intricate web of state regulations and garnering consensus among stakeholders.

Consumer Resources and Advocacy

As the discourse surrounding credit card interest rate caps unfolds, consumer advocacy groups urge individuals to remain vigilant and informed about their financial obligations. They emphasize the importance of understanding the terms and conditions associated with credit card agreements, including interest rates, fees, and repayment schedules.

Additionally, consumers are encouraged to explore alternatives to high-interest credit cards, such as personal loans or credit unions, which may offer more favorable terms and lower interest rates. By proactively seeking out competitive financing options, individuals can mitigate the impact of high-interest credit card debt on their financial well-being.

Conclusion

Donald Trump’s proposal to cap credit card interest rates at 10% represents a significant departure from the current landscape of consumer lending. While the promise resonates with many individuals grappling with the burdens of high-interest debt, the feasibility and implications of such a cap warrant careful consideration.

The complexities inherent in implementing a national interest rate cap, coupled with the divergent perspectives on its potential impact, underscore the need for a nuanced approach to addressing consumer debt. As the debate unfolds, consumers are urged to remain informed and proactive in managing their financial commitments while advocating for fair and transparent lending practices.

Share news